The largest single order for sodium power! Lithium prices plummeted, but sodium power still showed signs of "heating up"

2024-09-27 18:00The recent rise of sodium batteries is mainly due to the surge in lithium battery prices around 2022, which led to the emergence of sodium batteries in 2023. Even in early 2024, their supporting models were launched one after another, and there were constant news of tens of billions of yuan of sodium battery capacity construction . At that time, the industry generally believed that sodium batteries were about to be mass-produced.

However, after entering the second half of 2024, sodium batteries seem to have suddenly lost their former "heat". What is the reason for this? What is the current industrialization progress of sodium batteries? Will it "heat up" in the future?

Industry insiders pointed out that sodium batteries have not "disappeared" and their commercialization process has maintained rational development in "adversity."

01

Lithium prices plummet, sodium battery commercialization in trouble?

In terms of the market , the industry's previous high expectations for sodium batteries were closely related to the surge in lithium prices. As the price of lithium carbonate plummeted from its historical high of about 600,000 yuan/ton to the current 73,000 yuan/ton, a drop of more than 87%, sodium batteries, which have entered the public eye with their core mineral cost advantage, are facing a somewhat embarrassing situation.

Data shows that in the field of power batteries for electric vehicles, China's installed capacity of sodium batteries will be 1.5MWh from January to July 2024, while the installed capacity of lithium iron phosphate batteries and ternary lithium batteries will be 171.1GWh and 73.6GWh respectively. Obviously, although sodium batteries have been installed, their installed capacity is not comparable to that of lithium batteries.

Industry insiders said that although the application of sodium batteries in the field of electric vehicle power batteries has been hindered, they are still expected to be used in low-speed vehicle scenarios (A0-class and below electric vehicles, two-wheeled vehicles, electric forklifts, start-stop power supplies, etc.) and energy storage scenarios.

In recent times, China's sodium battery industry has not only made continuous breakthroughs in orders and commercial applications , but also a number of sodium battery and material projects have been launched one after another, which also proves that the industry's "enthusiasm for sodium batteries remains."

02

Sodium power orders/commissioning are increasing, and capacity construction is in full swing

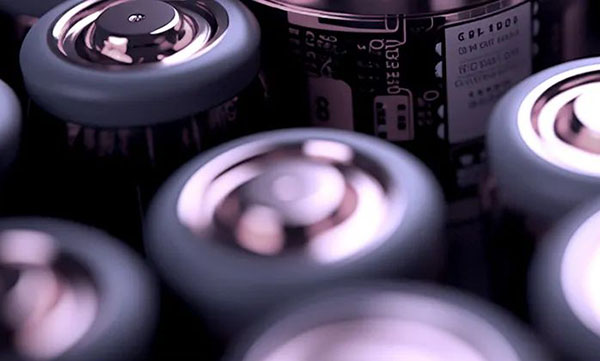

In terms of orders and deliveries, Chinese companies have won the largest single order for sodium batteries in the global light power sector, and some companies' sodium salt batteries have been continuously shipped to overseas markets.

On September 3, Zhongna Energy announced that its wholly-owned subsidiary Taizhou NaNa Energy Technology Co., Ltd. signed a formal supply contract with a well-known domestic light power battery sales company on August 30. Taizhou NaNa will provide the demander with no less than 50,000 sets of Polysodium No. 1 48V/60V series battery products in the next six months, with a total contract value of nearly 40 million yuan.

Data shows that in August this year, Taizhou NaNa has successfully shipped to customers in multiple application scenarios such as two-wheel, urban cleaning, battery replacement, and energy storage, and has gradually switched to continuous mass production.

Zhejiang Anli Energy Co., Ltd., a subsidiary of Chaowei Group, recently delivered 100 sodium salt battery packs to South Africa.

In terms of application, sodium batteries have appeared in new energy storage systems put into operation in many places in China.

Among them, after the first phase of Datang Hubei 100 MW/200 MWh sodium ion new energy storage power station science and technology innovation demonstration project is put into operation, it is reported that it can be charged and discharged more than 300 times a year, and a single charge can store 100,000 kWh of electricity; releasing electricity during the peak period of the power grid can meet the daily electricity needs of about 12,000 households.

In terms of capacity construction, a number of companies have recently signed contracts or started construction of sodium power projects:

Up to now, not only companies such as CATL, Farasis Energy, and China Science and Technology Sodium Battery have realized the application of sodium batteries in electric vehicles, but also companies such as Zhongna Energy, BYD, Chaowei, and Sodium Innovation Energy are actively promoting the application of sodium batteries in two-wheeled vehicles, energy storage and other fields.

03

Sodium batteries may be comparable to lithium iron phosphate batteries in the future

The reason why sodium batteries have not yet formed a large-scale replacement for lithium batteries and lead-acid batteries is mainly because: first , from the perspective of technology research and development, there is still a large gap between sodium batteries and lithium batteries in terms of energy density and other aspects; second , from the perspective of large-scale intelligent manufacturing, lithium batteries and lead-acid batteries both have mature industrial chains and supply chains, and their production costs are much lower than sodium batteries; while sodium batteries are currently still in the stage of multi-technology route research and development and product verification, and the problem of high production costs needs to be solved.

In the view of Battery China, despite facing the above-mentioned multiple challenges, the advantages of sodium batteries are sufficient to support their long-term resilient development.

Compared with lithium batteries , although the energy density and cycle life of sodium batteries are lower than those of lithium batteries, they have advantages in low-temperature performance and over-discharge resistance; sodium salt raw material resources are abundant and inexpensive; aluminum foil can be used as the negative electrode current collector to reduce the cost and weight of the battery cell; the current leading sodium-ion battery cell energy density is already above 160Wh/kg, and is expected to be comparable to lithium iron phosphate batteries in the future.

Compared with lead-acid batteries , sodium batteries are significantly superior to lead-acid batteries in terms of energy density, operating voltage, cycle life and environmental friendliness.

Based on the above characteristics of sodium batteries, sodium batteries will have great market competitive advantages in the future in low-speed vehicles and energy storage fields that are relatively insensitive to energy density.

The first-generation sodium battery launched by CATL has an energy density of 160Wh/Kg and has been installed on vehicles. The research and development target of its second-generation sodium battery is to exceed 200Wh/kg.

According to the data, CATL recently obtained a new invention patent authorization, the patent name is "Positive electrode sheet for sodium ion battery, sodium ion battery and power device", the patent application number is CN202311413954.0, and the authorization date is August 30, 2024. According to the relevant description, the positive electrode sheet provided by the application can improve the cycle performance and safety performance of sodium ion batteries.

Farasis Energy plans to launch its second-generation sodium-ion battery in 2024, with an energy density expected to reach 160-180Wh/kg; in 2026, its energy density will be further increased to 180-200Wh/kg to meet the application needs of more scenarios.

Lishen Battery has released its second-generation sodium-ion battery, with a cell energy density of 160Wh/kg, 10% higher than the first generation; it can achieve a discharge capacity retention rate of more than 80% at -40°C; it can achieve 5C fast charging, reaching 80% of the power in 12 minutes, and will be mainly used in electric bicycles, A00 electric vehicles, large-scale energy storage and other fields.

According to rough statistics, two-wheeled vehicle manufacturers such as Tailing, Yadea, Aima, Xinri, and Zongshen have launched a number of sodium-electric two-wheeled vehicles; hundreds of battery industry chain companies such as CATL, Farasis Energy, EVE Energy, Lishen Battery, BYD, Sino-Belgian New Energy, Zhongna Energy, and Cube New Energy are competing in the sodium battery field, helping to optimize sodium battery technology and solve cost reduction problems.

South Korea's SNE research predicts that by 2035, sodium batteries will be at least 11% cheaper than lithium iron phosphate batteries, and up to 24% cheaper.

Recently, the State Administration for Market Regulation issued a notice to solicit public opinions on the national standard for "Sodium-ion batteries for electric bicycles". With the formulation and release of the national standard for sodium batteries, it is expected to bring new development opportunities to the sodium battery industry.

The "9th Power Battery Application International Summit (CBIS2024)" co-organized by the China Chemical and Physical Power Sources Industry Association and Battery China Network is scheduled to be held in Shanghai from November 18 to 20, 2024. The theme of the summit is "Towards Innovation and Integration - Creating a New Era of Industrial Cooperation". Lyric Robotics is the title sponsor of this summit.

At the parallel forums of the summit on "Characteristics and Material Systems of Sodium-ion Batteries" and "Applications and Challenges of Sodium-ion Batteries"held on November 19 , experts, scientific research institutions and corporate representatives from the fields of sodium-ion batteries, key materials, key technologies of BMS, sodium-electric applications, etc. will have in-depth exchanges and discussions on hot topics in the field of sodium-ion batteries. Please stay tuned!